Thoughts on building a new home

This is a follow up to my ongoing series about my building a new house in Del Webb Stone Creek. When you build new you should be prepared to live with construction noise and dust for 6 to 12 months.

How to find and buy a house in the Ocala Marion county Florida area including 55+ retirement homes, golf course homes, short sales and foreclosures.

This is a follow up to my ongoing series about my building a new house in Del Webb Stone Creek. When you build new you should be prepared to live with construction noise and dust for 6 to 12 months.

Exceptional SW Ocala pool home. Gorgeous mature landscaping. Over sized side entry garage. 3 bedrooms, 2 baths, 1926 sqft living area with formal dining area, living room, family room,. Propane gas for cooking, water and dryer. Washer Dryer stay new in 2018. Irrigation well for low water bills. Powder coated aluminum fence in side yard. Huge Lanai with in-ground pool. Minutes to SR 200 shopping, dining and health care. Not in a retirement community. Very low HOA fees. Offered at $229,900.00. Owner Agent. Call or email for more info. SOLD

More pictures

February was very warm this year. The winter here in Ocala is pretty much over and we didn’t even have a light frost. Some days were even on the low 80’s ! Almost all the rest were in the mid to low 70’s. That is exceptionally warm.

March is the beginning of spring here in Ocala. The grass is greening up. The azaleas are in bloom. Ocala is getting green and warm. There is no humidity this time of year and there won’t be any humidity until June.

Don’t live up north through another winter. Call me, email me or use my Ocala Dream Home Finder I will find you a great house where it never snows !

Prices have gone up a lot since the great real estate crash of 2008 but there is no bubble like back then. There is not an over supply of homes. In fact there is an under supply and we are in a sellers market. There are not enough new homes being built. We need more builders to step up and start new major projects. Right now builders outside of 55+ are just buying lots in established subdivisions instead of breaking ground on new communities. On Top of the World is planning a huge new community that will be both 55+ and Not 55+ later this year. Another reason there is no bubble is that we don’t have the crazy types of loans that are almost guaranteed to fail like we did back in the great recession. Even though prices have gone up Ocala is still lower priced than most of Florida and a lot less than the rest of the country. A bonus is that it never snows here !

I was taking a Realtor class, getting credits for my next license renewal. The subject was about tech for Realtors. To be honest I didn’t expect much and I went because I had nothing else to do that day. Much to my surprise I picked up several good tips. One of the most interesting things was that Zillow rates it’s own accuracy. And I mean they rate themselves right down to the county level.

Zillow is a site that buyers and sellers seem to love and Realtors see as inaccurate. Who is right ? The following is accuracy results that Zillow publishes about it’s own Zestimates.

In Ocala and Marion County as of July 25 2018 for a 3 month period ending July 30

Zillow gives itself 2 out of 4 stars

50% of it’s Zestimates were within 5% of the sold price

70.5% of Zestimates were within 10% of the sold price

83.5% of Zestimates were within 20% of the sold price

Median error is 5% of the sold price

Those are pretty big numbers to be off. 5% is a $10,000 error on a $200K home. I will give Zillow credit. If you read about Zestimates they say that they are only a starting point and are not the same as a Comparable Market Analysis or an Appraisal. Websites are no substitute for a local expert.

A Listing Portal is a custom search on the Ocala/Marion County MLS that creates an account with an ID and password. A buyer will use my Dream Home Finder to provide the information that I need to set up a search. I sometimes use the Dream Home Finder AS IS and I sometimes need to email the buyer to clarify some issue or to make a recommendation. Once the search is set buyers will get an automatic email when ever a new home, that conforms to their search criteria, gets listed. After setting up the Listing Cart I don’t contact my buyers unless they contact me for more info, want to change their search or are ready to see a home. I once had a Listing Cart set up for a buyer from Chicago and it took him 3 years to close down his business and sell his house. I’m very patient.

I can’t help buyers who don’t give me enough information. Too many people will use my Dream Home Finder and just fill in Single Family and a price range. A search like that will get 1,000 hits, no kidding. I need to your your price range. The sq ft of living area, not including the garage or Lanai. The type of home, single family, 55+, pool home ect. There is also a comment section. This is where you tell me that you want to only want a 55+ community with lower HOA fees. Don’t say low fees give me a number.

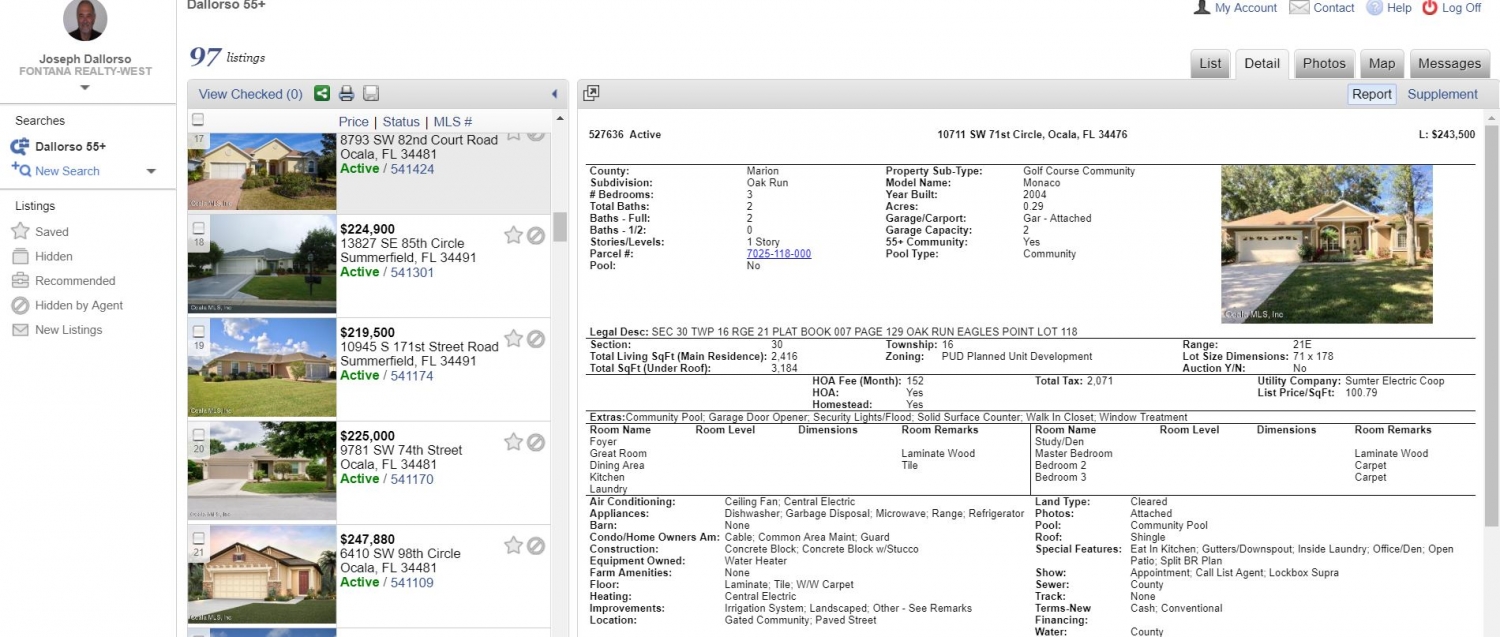

Below is a screen shot showing what the Listing Portal looks like. On the top there are 5 Tabs. The first is the List View. Next is the Detail View which shows the home size, age, current taxes, HOA fees everything about the home. Photos are next and there can be as many as 50. Drone shots are becoming popular. The Map tab not only shows the location but there is also a Satellite view that zooms in and out. You can email your listing to someone and you can add other email accounts by contacting me. You can rate a listing and make a comment or a note. You can print a listing. There will be some homes that you just don’t like so there is a delete button. The Portal is a direct link to the Ocala MLS. Everything is up to date. All listing on Realtor.com Zillow or where ever originate here.

Listing Portal

In Marion County the seller traditionally pays for title insurance and a tile company handles the closing. The seller pays Documentary Stamps a Florida tax on the sale of a home that is .007 % of the sale price. Unlike resales new home builders don’t pay either for title insurance or Doc Stamps. On a $200,000- home Title Ins. and Doc Stamps would ad up to $2700- +/-.

Some builders offer incentives, a fee at closing to the buyers. These vary by the builder and depend on how sales are doing. You might see them on a Spec home that has been there a while, a model that isn’t the most popular or a home on a less desirable lot. Incentives can offset closing costs.

Most of my buyers are looking for a retirement home and quite a few use money from the sale of an existing home in a more expensive part of the country to buy a home for cash here in Ocala. A lot of people don’t like the idea of not having a mortgage hanging over their heads in their retirement years. What some buyers don’t realize is that there are very few closing costs associated with a cash sale.

All of the big money for closing costs come from getting a loan. It is up to the bank to estimate closing costs associated with their loans. From what I have seen closing costs run between $5-$7K on most loans. The funny thing is closing costs can be crazy high on small loans. I saw a buyer get a $50K loan to suppliment cash he had and the closing costs were 5,000 ! I said that’s 10% !

Title and closing. The seller here pays for title insurance and doc stamps (tax on sale). A title company researches the title and delivers a full warranty deed. The title company handles everything to do with the closing.

HOA fees are pro rated to the day of closing. Some HOA’s have a set up fee and a couple have an HOA contribution fee. Some HOA’s want a month or 2 in advance to get started.

Inspections. Everyone needs a professional home inspection which includes a termite inspection. Many get a wind mitigation certificate for their insurance company which lowers the rate a little. An inspection will run in the $350 +/- range depending on what you inspect.

Survey. Being cash there is no bank that requires a survey. 55+ communities are planned communities. However is you don’t get a survey there will be an exclusion on your title insurance saying that you didn’t provide a survey. Most buyers get a survey but not all do. A survey even on a small lot like in 55+ will be $300 +/-.

I was showing retirement homes to a single guy from up north, He saw a few homes he liked but friends kept telling him he should look at more cities. They told him to rent a house for a while and take his time looking.

I told him about a couple who rented in On Top of the World for a year. They wanted to be sure they liked it there. After I found them a house I said to the wife that prices had gone up a lot in that year. She agreed and thought it was a good $5-$10,000. In addition she and her husband spent another $1200 a month in rent.

A few things to think about if you think renting and looking is a good idea.

55+ communities restrict rentals most are a minimum of 6 months and landlords prefer a years lease.

Timing can be a problem. What if you find a perfect house in the first month ? Do you wait and hope it doesn’t sell right away ? Do you go for it knowing you will owe the rest of your lease ? Expect to pay a good $1000 a month in rent. Three four or five months rent is a lot if you find a house right away.

I suggested to my buyer that if he wanted to see other areas he’d be better off just driving around and staying in a nice hotel for a few days in each city. It’s cheaper in the long run than getting involved in a 6 month plus lease. He had to admit the 2 days he spent with me looking at communities and homes gave him an excellent idea of what we have here in Ocala for 55+ homes.

I was just involved in a multiple offer situation. I don’t see them all the time but this was the 2nd one this year. Both were on 55+ homes which are my specialty. Both also had borderline over the top renovations.

A few things to know about multiple offers. The seller does not have to accept the first offer they get. The sellers can do what ever is in their best interests. Sellers don’t have to disclose that they have other offers. Sellers sometimes will ask for a buyers “highest and best” offer but do not have to. A seller doesn’t have to accept the highest offer. They may for example take a cash offer with no contingency other than an inspection over a higher offer with financing.

In order to win in a multiple offer situation it helps to pay cash and make as AS IS offer asking for no repairs. Offers with financing or even cash contingent on the sale of your existing home with lose out most every time to the cash AS IS offer.