The Listing Portal is a Custom Ocala MLS Search

A Listing Portal is a custom search on the Ocala/Marion County MLS that creates an account with an ID and password. A buyer will use my Dream Home Finder to provide the information that I need to set up a search. I sometimes use the Dream Home Finder AS IS and I sometimes need to email the buyer to clarify some issue or to make a recommendation. Once the search is set buyers will get an automatic email when ever a new home, that conforms to their search criteria, gets listed. After setting up the Listing Cart I don’t contact my buyers unless they contact me for more info, want to change their search or are ready to see a home. I once had a Listing Cart set up for a buyer from Chicago and it took him 3 years to close down his business and sell his house. I’m very patient.

I can’t help buyers who don’t give me enough information. Too many people will use my Dream Home Finder and just fill in Single Family and a price range. A search like that will get 1,000 hits, no kidding. I need to your your price range. The sq ft of living area, not including the garage or Lanai. The type of home, single family, 55+, pool home ect. There is also a comment section. This is where you tell me that you want to only want a 55+ community with lower HOA fees. Don’t say low fees give me a number.

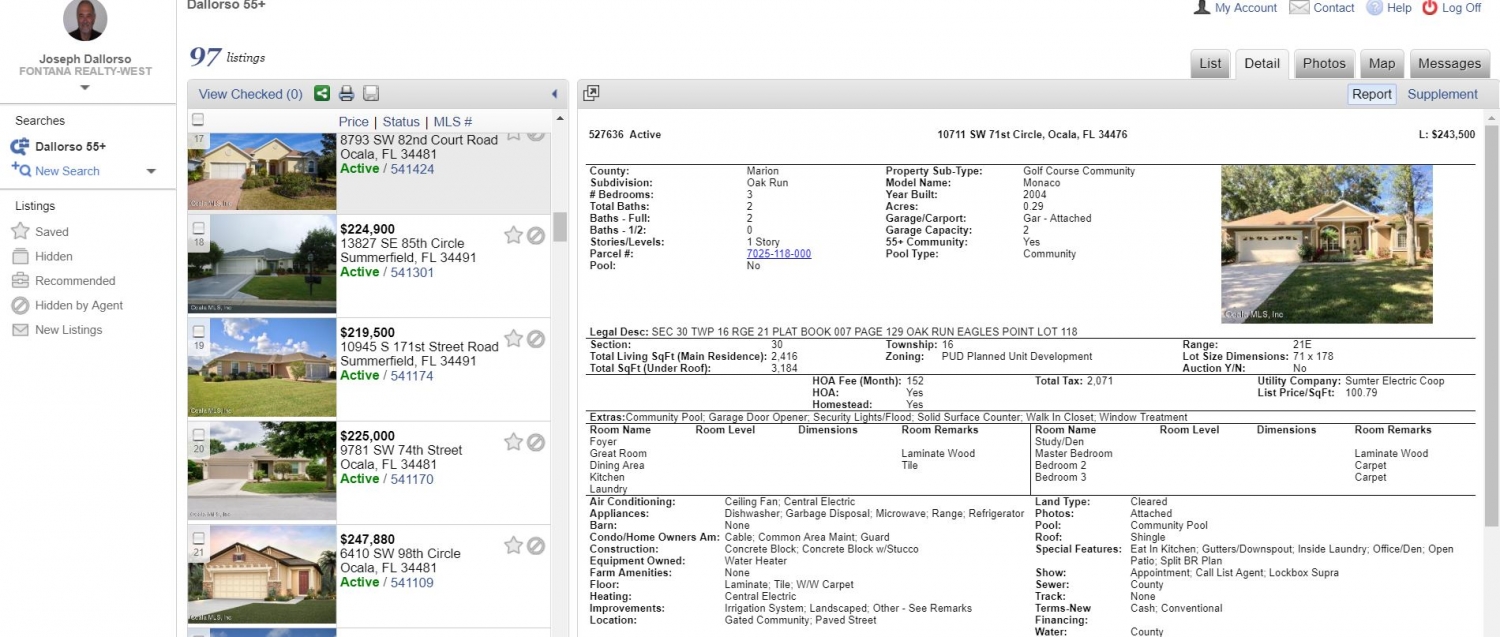

Below is a screen shot showing what the Listing Portal looks like. On the top there are 5 Tabs. The first is the List View. Next is the Detail View which shows the home size, age, current taxes, HOA fees everything about the home. Photos are next and there can be as many as 50. Drone shots are becoming popular. The Map tab not only shows the location but there is also a Satellite view that zooms in and out. You can email your listing to someone and you can add other email accounts by contacting me. You can rate a listing and make a comment or a note. You can print a listing. There will be some homes that you just don’t like so there is a delete button. The Portal is a direct link to the Ocala MLS. Everything is up to date. All listing on Realtor.com Zillow or where ever originate here.

Listing Portal