Buying in a sellers market

A few random thoughts about options and potential problem when making an offer in a sellers market.

Cash. Cash offers without a doubt gives the buyer an advantage. In Ocala though cash offers are not that unusual. We see them often. Cash with no contingency other than an inspection can’t be beat.

Contingencies. Contingencies are a disadvantage. An offer with a contingency on the sale of an existing home is the worst. Even before the current sellers market list agents and sellers were nervous about the sale of a buyers home. Finance contingency will lose out to cash every time. A loan with a local lender is usually look on as better than a big national bank.

Inspections. I put this in it’s own category instead of as a contingency. I have heard of buyers in super competitive situations skipping an inspection and I think that is just crazy. Maybe and just maybe if a house was a year or 2 old but even then I think an inspection should be done.

AS IS. An AS IS contract means that you do an inspection but the seller makes no repairs. The buyer can take it or walk away. Some list agents don’t like AS IS because unlike the traditional contract that locks the buyer in unless the repair limit is exceeded, in an AS IS the buyer can walk away during the inspection period. If a seller is open to AS IS it can be an advantage for the buyer.

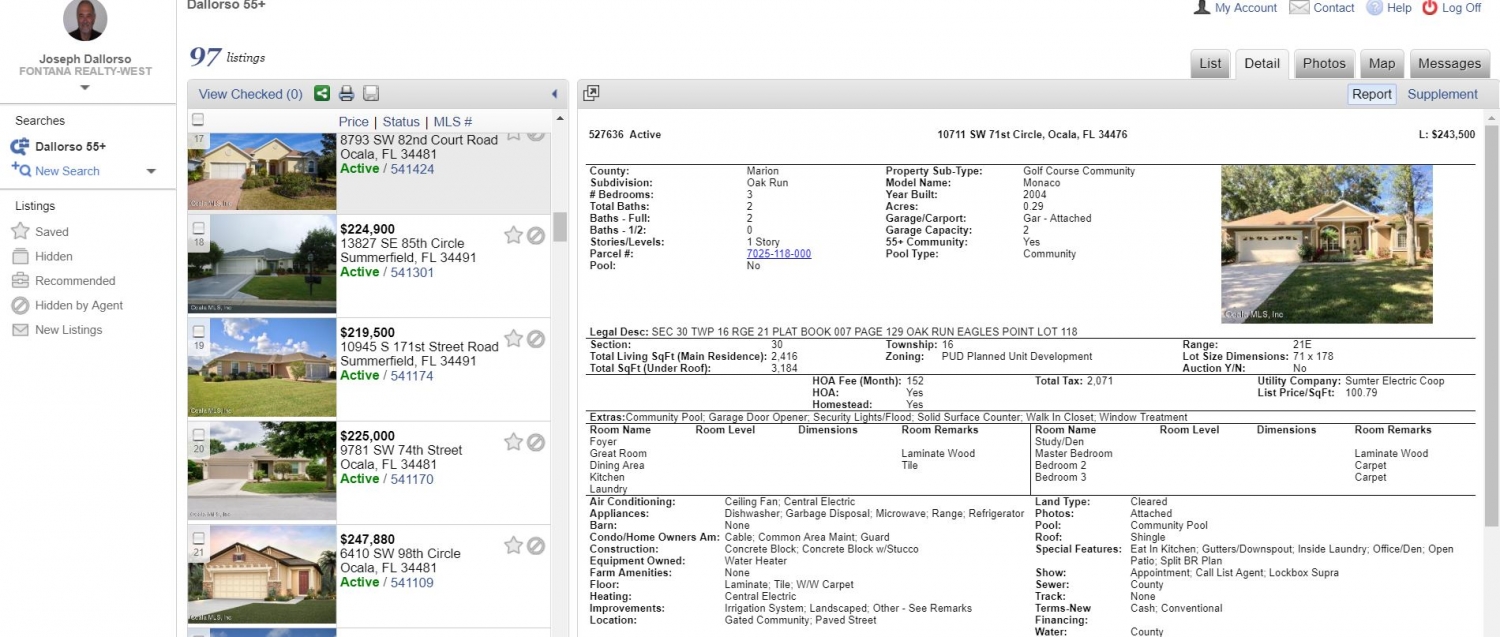

Sight Unseen. By that I mean making an offer based on what you see online without actually visiting the house. I’m not a fan and don’t think I would buy a house like this but some people do. I have sold 6 or 7 sight unseen homes. I do a walk through looking for things that you can’t see on MLS images. I have also done short video walk throughs to get a feel for the property. I only do walk throughs and videos for buyers who are drop dead serious about making an offer on a specific home.

Renting. There are few to none short term rentals here in Ocala other than an Air B&B. Ocala 55+ communities have various restrictions against renting short term. Renting long term is hard to find and during the lease term home prices will go up and you’ll be spending $1500 to $2000 a month during the lease. I’ve been told there are short term rentals down in the Villages but that’s all I know. I don’t do rentals at all.